- Related capabilities

Addisons’ Private Equity team has a long track record of advising Australian and international private equity firms on all aspects of the private equity lifecycle, guiding them to achieve their investment goals.

We advise clients across the life of their investment, from fund establishment, internal fund carry and equity arrangements including succession issues, to investments, bolt-on acquisitions and various portfolio company transactions, through to investment realisation.

We regularly advise offshore private equity firms and their advisers on Australian foreign direct investment rules.

Our team members are known for their responsiveness, commercial perspective, and ability to focus on the essential issues. Clients value our clear, direct and practical advice on the various legal, regulatory and commercial aspects of their transactions.

acted for Anacacia Capital in respect of its investments in Pump Haircare and Force Fire Group, as well as bolt-on acquisitions for its portfolio companies.

acted on their acquisition of the Asia–Pacific pharmaceuticals business of 3M.

advised on the sale of iNova Pharmaceuticals.

advised on its acquisition of the Dusk and Adairs retail businesses.

acted on the fundraising and establishment of the Ironbridge Capital Funds I and II and various special purpose investment funds.

advised Permira on its $1.3 billion acquisition of I-MED Radiology Network from EQT.

Best Law Firms™ Australia – Sydney

2025-2026 | Commercial Law

2025-2026 | Private Equity Law

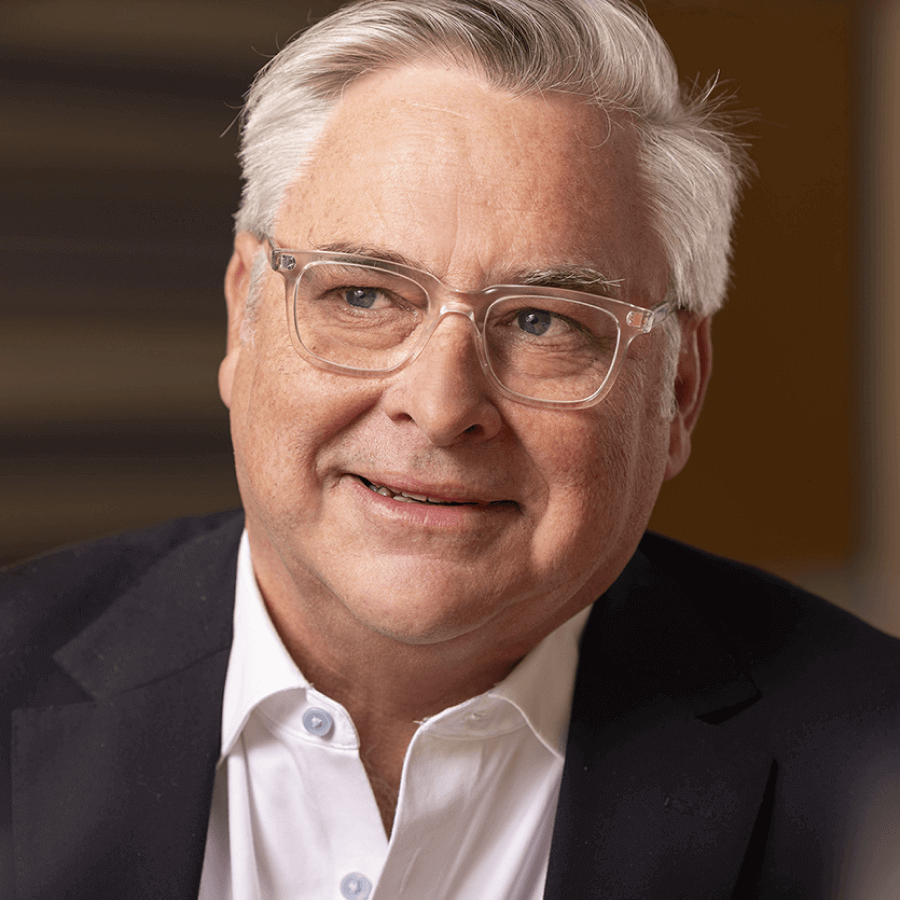

David Stammers attracts praise as a partner who has a "well considered and commercial" approach and is "very good at distinguishing the important from the unimportant.”